Finally, our internal policies must reflect a cornerstone of compliance. We regularly review and update our payroll procedures to prevent future arrears from occurring. Robust training programs are also implemented to ensure that our staff can navigate the complexities of payroll management confidently and competently. Inform them about your circumstances and your intention to resolve the arrears. Creditors are often willing to cooperate if they see efforts to settle the debts. This approach may also result in more affordable payment terms or temporary relief.

Fed up With Late Client Payments? Get Paid Faster With 3 Tips

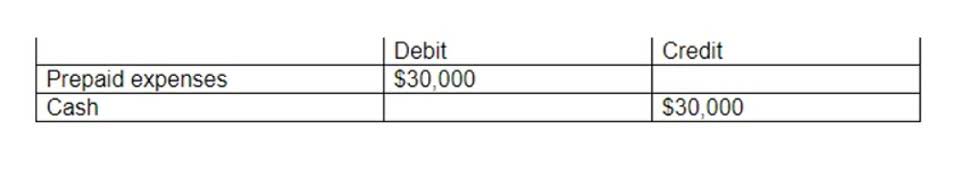

QuickBooks is your all-in-one solution for your accounting, payment, and payroll needs. Paying in arrears takes on a slightly different meaning in accounting. When you pay for goods and services after they’ve been received, they’re paid in arrears. For example, imagine that you purchase services from a vendor with net 30 payment terms. This means that you have 30 days to submit your payment after receiving the service.

- That’s why accurate and timely record-keeping is essential for seamless payroll operations.

- Whilst some arrears payments are agreed upon, “payment in arrears” can also refer to late payments.

- Arrears payroll payments give you time to accurately record employees’ hours.

- Managing payroll can be like navigating a labyrinth, with various paths leading to the tricky situation of arrears.

- To manage payments in arrears, it’s important to track expenses and income.

- Not in certain contexts, such as in bond trading, when arrears is a reference to payments that are made at the end of a specified period.

What is paid in arrears?

Then, calculate the amount from the previous paycheck to the current pay period. Finally, subtract any amount already paid for this period, and add extra wages for tips, overtime, or employee benefits. In some cases, billing or paying in arrears can result in overdue payments. This typically happens when payments are recurring, such as ordinary annuity payments, child support payments, mortgage payments, car loan repayments, and so forth. With recurring payments, payments are usually made on a set schedule without much work needing to be done on both the giving and receiving end. Accounts payable refers to the money a company owes to its creditors.

Boost Your Email Game: Master Productive Management

Perhaps your employees have become accustomed to the current payment system, and the transition from paying in current to paying in arrears is not something they anticipated. It’s also important to comply paid in arrears with local, provincial, and federal labor laws when processing payroll. Billing in arrears is often preferred over billing in advance because it can help businesses avoid certain miscalculations.

Benefits and Disadvantages of Paying in Arrears

From an employer’s perspective, a biweekly schedule reduces the administrative burden compared to weekly payroll. It also simplifies the calculation of overtime for hourly workers, making it a practical choice for many businesses. When managing workforce payment, preventing payroll arrears is crucial for maintaining financial stability and ensuring employee satisfaction. Early detection and proactive measures are key strategies to avoid the accumulation of unpaid wages. We’ve identified several effective tactics that help mitigate the risk of falling into arrears.

Why Do Companies Often Pay in Arrears?

- 2) Scrap the New Pension Scheme (NPS), and Restore the Old Pension Scheme (OPS) for all employees.

- Paying in arrears helps you manage cash flow more effectively by delaying payment until work is completed and payment has been received from your clients.

- We need to navigate the complexities of payroll management while ensuring compliance with legal standards and maintaining employee satisfaction.

- When employees are paid monthly in arrears, it gives the business time to calculate tips, commissions, and overtime hours.

- For employees, delayed income and non-payment from a previous pay period can negatively impact their ability to handle utility bills, care payments and their credit score.

- If you’re paying in arrears on accounts payable, making these payments on time is crucial.

The opposite of paying in arrears would be upfront or an advance payment before work is complete. For accounting purposes, arrears refers to settling accounts for goods and services with external vendors. For example, suppose a supermarket receives a new shipment of fresh milk.

If you’re paying in arrears on accounts payable, making these payments on time is crucial. With recurring payments, payments are usually made on a set schedule without much work needing to be done on both the giving and receiving end. In arrears payroll is simpler to process and more accurate than current payroll. The only drawback is employees usually prefer faster access to their wages. Often, however, they don’t realize that their payments reflect a previous pay period, especially if their work schedules are consistent.