This requires special software program that provides you entry to an exchange. It additionally requires a deeper information of buying and selling as a result of you must manually search through an exchange’s order e-book. That’s not a straightforward thing to do if you’re new to trading as a end result of you have to learn worth quotes and understand how to choose the best ones. Execute your orders in opposition to a quantity of liquidity venues, together with primary exchanges, multilateral trading facilities (MTFs), dedicated market makers and darkish pools. This can additionally be as a end result of trading in such high frequency could only be worthwhile when you trade actually high quantities of volume. So you may guess that, from a cost-benefit perspective, high-frequency traders are those who can doubtlessly revenue from this ultra-low latency.

DMA presents many benefits but may only be appropriate for advanced traders. You would search the L2 Dealer platform for the most effective value out there to either purchase or promote the underlying market. Then, you’ll place an order and your broker would do a fast check to see if you had sufficient margin to open the position. The needed checks take a fraction of a second, after which your order shall direct market access be positioned immediately onto an exchange’s order books. There, you’ll have the ability to see different market participants’ orders and gauge market sentiment in your chosen asset. The needed checks only take a number of seconds, after which your order will be placed directly onto an exchange’s order books.

How Dma Buying And Selling Works

Can this DMA which is at present provided only to institutions be made out there to HNIs or large retail investors? It is feasible, perhaps one thing could be at work and in addition possibly what created the hearsay, which led to what I suppose is faux news, and caused broking stocks to fall whereas trade stocks rose. But, the present way of offering DMA to retail includes a brokerage firm. Also, we can say that, if you’re a dealer who operates with high volume levels, you then might must function with direct market entry brokers who offer CFDs so your big orders don’t transfer the market.

- Whereas, direct market access permits a trader to directly execute the trade orders with the change.

- DMA buying and selling also provides traders with entry to market depth, which shows the present bid and ask costs for a selected safety, as properly as the amount of orders at every value degree.

- This is important whereas buying and selling on huge markets as in illiquid ones.

- I could not more extremely suggest Guardian Stockbrokers, everybody has been sensible.

- This type of control over trading actions is considered sponsored entry.

- The which means of direct market entry with algorithmic buying and selling additionally helps to reap the benefits of order execution and quick transactions that merchants could not have time to identify themselves.

Companies that supply direct market entry typically combine this service with entry to advanced trading methods corresponding to algorithmic trading. Thus, there are agreements between direct market entry platform owners and sponsored corporations that outline the services offered and the stipulations of the settlement. Contracts for difference (CFDs) are trades between a CFD supplier and a client. A CFD does not give ownership of the underlying monetary instrument to the client. It is an settlement between the CFD provider and the shopper to settle in cash the difference between the opening and shutting costs of the CFD.

Stock Market Reside Updates: Sensex Declines 350 Pts, Mid, Smallcap Indices Fall 2%

The direct market access facility permits a trader/institution to trade in the financial market with none middleman. Trade instantly out there, full market depth and entry to darkish liquidity swimming pools with either CFD dealing or standard share dealing. Direct market entry (DMA) differs from over-the-counter (OTC) in that DMA places trades directly with an exchange while OTC happens outdoors of exchanges and directly between parties.

Google is listed on the NASDAQ exchange underneath its father or mother company’s name, Alphabet Inc. As a trader, you ought to use a DMA platform to buy shares in Alphabet directly from NASDAQ. This means you’re bypassing any third-party brokers and getting them straight from the supply. Stockbroking is an especially complex enterprise that carries infinite threat in phrases of compliance, operations, and expertise.

Direct Market Access (dma)

The CFD provider offers the trader a quote with an ask worth based on the price of the underlying financial instrument within the direct market. These orders are then aggregated by the CFD supplier and positioned in the direct market for execution. The rules concerning repeat trades and rejections can be harder when you’re trading instantly with an exchange. This is as a end result of every thing is being written onto the exchange’s order guide and there isn’t scope for failed transactions as a end result of it can upset the entire ecosystem.

Changes in provide and demand affect the market which implies your strikes are affecting the costs everybody else sees. All of this happens in the background and can take just a few seconds. That’s one of many primary causes online buying and selling has turn out to be so accessible, reasonably priced, and well-liked. Brokers, aka the middlemen, handle all of the technical stuff and also you get to purchase and sell by tapping a couple of buttons.

What Is Direct Market Entry (dma)?

I thought perhaps someone from the trade should make clear, in layman’s terms, why it’s unlikely that the exchanges will take care of retail investors immediately, a minimum of in the near future. If you want to buy shares outright through DMA, you would search the L2 Dealer platform, the share dealing web platform or the cell app for the most effective value that can be purchased. You would need to have the total amount of money required to open the place in your account. As with trading, your order might be placed onto an exchange’s order books where you can see different exercise and analyse market sentiment. Now contemplate that you want to do risk administration for tens of millions of consumers and take that risk on tens of millions of trades every day.

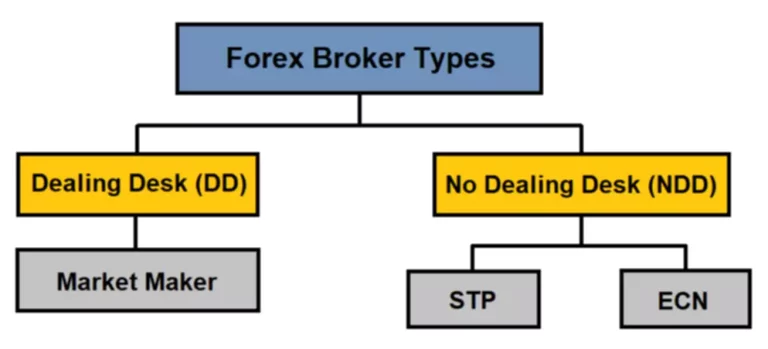

These may embrace asset management companies and personal buyers. In the international exchange market, orders are normally positioned on the order books of ECNs. In the share market, orders for DMA share buying and selling are often positioned in the central limit order book of an exchange.

Whatever instrument you commerce, you’ll place an order immediately onto the order books of an exchange. The core of an change is its matching engine — the expertise that matches a purchase order and a sell order towards a bid and ask value to generate a commerce. This trade value (LTP) and open orders are streamed to brokers who use this to feed their buying and selling platforms (marketwatch, charts, etc.).

And this isn’t simply the risk with delivery trades illustrated above, but in addition the 99% leveraged trades where the risk is significantly higher by a number of orders of magnitude. So exchanges around the world delegate client-level risk management to brokers and don’t look at particular person clients’ danger. So if Zerodha has three million clients, for NSE and BSE, Zerodha is only one entity who has kept funds on behalf of all the purchasers lying with them on which exchanges allow buying and selling.

Commerce On-line Your Method

You ought to all the time do what’s greatest for you when it comes to the belongings you commerce, the amount you danger, and the technique you utilize. DMA trading isn’t suitable for the majority of novice merchants, but it is one thing to suppose about as you gain extra expertise. Placing orders by way of an exchange means you’re doing it directly with a counterparty (i.e. if you’re shopping for, you’re connecting directly with a seller and vice versa). What’s extra, once you place the order with a counterparty, it’s executed instantly.

Direct market entry (DMA) is the direct entry to the order books of the monetary market exchanges that lead to every day transactions of securities. It is usually the companies similar to investment banks (CitiGroup, J.P. Morgan), hedge funds and so forth. that own direct market entry. Banks and other monetary establishments provide clients with direct market access to electronic facilities https://www.xcritical.in/ and order books of exchanges to facilitate and full trade orders. Some of the most well-known exchanges are the New York Stock Exchange (NYSE), the Nasdaq, and the London Stock Exchange (LSE). Individual buyers typically do not have direct market access to the exchanges. While trade execution is usually instantly enacted, the transaction is fulfilled by an middleman brokerage firm.