For some observers, the difference comes down to gambling versus investing. The former offers greater potential for gains in the short term yet resides much further out on the risk spectrum. As you join the cryptocurrency world, understand the importance of test transactions. Test transactions are an essential step when sending cryptocurrency because they allow you to confirm that the transaction will be successful before sending a significant amount of funds. Though they result in higher fees, they very well may be worth preventing a large error. Before investing in cryptocurrency, gain a personal understanding of what you hope to achieve as this will help set the course for your actions.

Crypto spot market

While technical traders move in and out of the market, ‘HODLers’ stay invested. ‘HODL’ is the crypto investment strategy to buy your coins and hold them for a long time as they increase in value. While it has become an incredibly Cryptocurrency Investment Strategy popular term in crypto, it reflects another popular idea from traditional finance; time in the market prevents timing the market. Cryptocurrency investing carries a substantial risk and should be approached with caution.

- Selecting the right crypto investment strategy can grow your portfolio and wealth, while helping you manage your risk (and your emotions).

- The coins to invest in are, therefore, ones that have the strongest fundamentals, chiefly real use cases.

- Passive investment strategies enable a more hands-off approach, where the management of the portfolio requires less time and attention.

- Before we dive into how to invest in cryptocurrency, it’s important to understand that there are good reasons to get involved, and there are poor ones.

- For example, Monero uses Ring Signatures and Confidential Transactions, which are great tools to maintain anonymity.

- These well-known coins have weathered several significant market cycles and downturns.

Don’t invest more than you can afford to lose

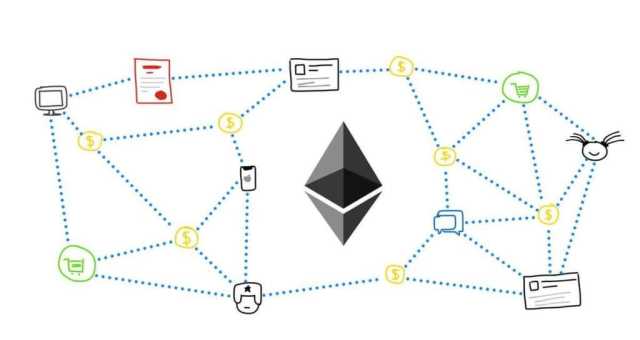

Here are other key things to watch out for as you’re buying Bitcoin. Many crypto blockchain databases are run with decentralized computer networks. That is, many redundant computers operate the database, checking and rechecking the transactions to ensure that they’re accurate.

Step 2: Select a cryptocurrency exchange

- Donovan suggests opening an account with a regulated and publicly traded company like Coinbase.

- This strategy is typically used in long-term investment portfolios, where the idea is simply to get in the market without any regard for timing.

- This means, you not only need to keep track of all your Altcoin trades, but you also need to take into account the price of Bitcoin when buying and selling.

- Get personalized financial advice from a Certified Financial Planner™ at one of the lowest prices on the market, only $11.99/month.

- Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer.

- Test transactions are an essential step when sending cryptocurrency because they allow you to confirm that the transaction will be successful before sending a significant amount of funds.

For more advanced investors, there are decentralized exchanges whose fees can be lower than those charged by centralized platforms. Those can be more difficult to use and demand more technical know-how, but they may also offer some security benefits because there is no single target for a cyberattack. Cryptocurrencies can also be traded through peer-to-peer transactions. While Bitcoin and cryptocurrencies have only been around for a little more than a decade, the HODL phenomenon could be compared to the buy and hold strategy.

Are cryptocurrencies a good investment?

Dollar-cost averaging is a popular investment strategy used across different asset classes. The strategy involves an automatic system of making fixed dollar amount investments (crypto allocation strategy), regardless of a token’s price. This strategy is best for investors who believe in projects with strong fundamentals and can afford not to see any returns for a few years. They buy crypto and hold it long-term to profit from a future price increase. Most crypto exchanges, for example, have a minimum trade that might be $5 or $10. As you would for any investment, understand exactly what you’re investing in.

This still-nascent market is prone to high volatility and uncertainty. However, crypto assets also present unique potential for those willing to accept the elevated risks. The phrase “buy low, sell high” succinctly encapsulates the buy-and-hold strategy. Also called position trading, the buy-and-hold strategy is one of the best investing strategies to earn passive income.

- By employing a successful cryptocurrency investment strategy, investors can mitigate risks and take advantage of opportunities in the ever-evolving digital currency space.

- The exchange uses proprietary security procedures, such as storing 90% of funds in cold storage and having an insurance policy that protects currency stored on the platform against security breaches.

- It’s well-established, and you know what you’re getting with Bitcoin.

- Different countries have varying approaches to cryptocurrency regulation, impacting market dynamics and investor confidence.

- If you’ve decided to invest in the cryptocurrency market, it’s important, as with any other investment, to do your research.